Running the numbers

Running the numbers

ON THE face of it, American higher education is still in rude health. In worldwide rankings more than half of the top 100 universities, and eight of the top ten, are American. The scientific output of American institutions is unparalleled. They produce most of the world’s Nobel laureates and scientific papers. Moreover college graduates, on average, still earn far more and receive better benefits than those who do not have a degree.

Nonetheless, there is growing anxiety in America about higher education. A degree has always been considered the key to a good job. But rising fees and increasing student debt, combined with shrinking financial and educational returns, are undermining at least the perception that university is a good investment.

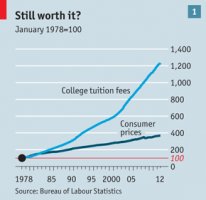

Concern springs from a number of things: steep rises in fees, increases in the levels of debt of both students and universities, and the declining quality of graduates. Start with the fees. The cost of university per student has risen by almost five times the rate of inflation since 1983 (see chart 1), making it less affordable and increasing the amount of debt a student must take on. Between 2001 and 2010 the cost of a university education soared from 23% of median annual earnings to 38%; in consequence, debt per student has doubled in the past 15 years. Two-thirds of graduates now take out loans. Those who earned bachelor’s degrees in 2011 graduated with an average of $26, 000 in debt, according to the Project on Student Debt, a non-profit group.

Concern springs from a number of things: steep rises in fees, increases in the levels of debt of both students and universities, and the declining quality of graduates. Start with the fees. The cost of university per student has risen by almost five times the rate of inflation since 1983 (see chart 1), making it less affordable and increasing the amount of debt a student must take on. Between 2001 and 2010 the cost of a university education soared from 23% of median annual earnings to 38%; in consequence, debt per student has doubled in the past 15 years. Two-thirds of graduates now take out loans. Those who earned bachelor’s degrees in 2011 graduated with an average of $26, 000 in debt, according to the Project on Student Debt, a non-profit group.

More debt means more risk, and graduation is far from certain; the chances of an American student completing a four-year degree within six years stand at only around 57%. This is poor by international standards: Australia and Britain, for instance, both do much better.

This is poor by international standards: Australia and Britain, for instance, both do much better.

At the same time, universities have been spending beyond their means. Many have taken on too much debt and have seen a decline in the health of their balance-sheets. Moreover, the securitisation of student loans led to a rush of unwise private lending. This, at least, has now been curbed by regulation. In 2008 private lenders disbursed $20 billion; last year they shelled out only $6 billion.

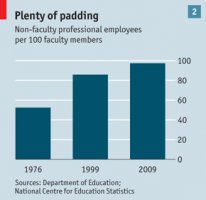

Despite so many fat years, universities have done little until recently to improve the courses they offer. University spending is driven by the need to compete in university league tables that tend to rank almost everything about a university except the (hard-to-measure) quality of the graduates it produces. Roger Geiger of Pennsylvania State University and Donald Heller of Michigan State University say that since 1990, in both public and private colleges, expenditures on instruction have risen more slowly than in any other category of spending, even as student numbers have risen. Universities are, however, spending plenty more on administration and support services (see chart 2).

![[PDF] The Shaping of American Higher Education: Emergence](/img/video/pdf_the_shaping_of_american_higher.jpg)